Photonic Integrated Circuits Market to Be Worth Over US$20B by 2034

2024年5月7日

James Falkiner

The Silicon Photonics and PICs market is experiencing robust growth, driven by the surge in AI and datacom transceiver demand. Key players in the industry, such as Intel, Coherent, and Infinera, are actively using PICs within their transceivers.

What are the benefits and challenges for Silicon Photonics and Photonic Integrated Circuits?

Photonic Integrated Circuits (PICs) are tiny optical systems made of materials such as Silica (Glass), Silicon, or Indium Phosphide. PICs enable everything from complex optical designs that allow billions of bits of information to be sent and received in a package the size of a candy bar to artificial noses that can detect different compounds and molecules in the air around them.

By leveraging the billions of dollars in investment in the CMOS chips, PICs can unlock new processing scaling potential beyond Moore's law. However, there are still significant challenges for the PIC market, such as material limitations, integration complexity, and cost management. Large demand volumes are required to offset the initial cost of designing and manufacturing PICs, and production lead times can take months. The brand new IDTechEx report on the topic, "Silicon Photonics and Photonic Integrated Circuits 2024-2034: Market, Technologies, and Forecasts", thoroughly investigates the PIC market and has identified Photonic Transceivers for AI as an emerging segment that is soon to be the largest source of demand for PICs.

What are the PIC materials of the future?

There is a wide variety of future PIC materials. Most of the current market uses Silicon and Silica-based PICs for light propagation; however, as an indirect semiconductor, Silicon is not an efficient light source or photodetector. Therefore, Silicon is usually combined with III-V materials for light sources and photodetection. Silicon's market dominance is set to continue; however, Thin Film Lithium Niobate (TFLN), with its moderate Pockels effect and low material loss, is emerging as a strong contender for applications that require high-performance modulation, such as quantum systems or potentially high-performance transceivers in the future. Monolithic Indium Phosphide (InP) continues to be a major player due to its ability to detect and emit light. Additionally, innovative materials like Barium Titanite (BTO) and rare-earth metals are being explored for their potential in quantum computing and other cutting-edge applications.

How AI is changing the demand for Silicon Photonics and PICs

The rise of Artificial Intelligence (AI) has spurred an unprecedented demand for high-performance transceivers capable of supporting the massive data rates required by AI accelerators and data centers. Silicon Photonics and PICs are at the forefront of this revolution, with their ability to transmit data at speeds of 1.6Tbps and beyond. As shown by Nvidia's latest Blackwell CPUs, which, according to IDTechEx's research, require approximately two 800G transceivers per GPU, the need for efficient, high-bandwidth communication is becoming more critical for AI, positioning Silicon Photonics and PICs as essential components in the AI-driven future. The biggest driver of the development of PIC transceivers is AI, as higher-performance AI accelerators will require higher-performance transceivers, with 3.2Tbps transceivers expected to arrive by 2026.

What are the future applications?

Other applications for Silicon Photonics and PICs vary - from high-bandwidth chip-to-chip interconnects to advanced packaging and co-packaged optics. These technologies are paving the way for next-generation computing.

Photonic Engines and Accelerators: Using certain photonic components, such as Mach-Zehnder Interferometers, and controlling these components through electro-optical interconnects, high-performance processors and programmable PIC devices can be designed and manufactured, unlocking higher performance than what is possible with electronic accelerators alone.

PIC-based Sensors: Certain PIC materials, such as Silicon Nitride, can used for a range of different sensors, from gas sensors to 'artificial noses'. The healthcare sensor industry may be able to take advantage of the miniaturization of optical components into PIC devices, which could see applications in Point-of-Care diagnostics or Wearables.

PIC-based FMCW LiDAR has the potential to transform the automotive and agricultural industries with applications in drones and autonomous vehicles.

Quantum Systems: Companies investing in Trapped Ion and Photon-based Quantum Computing are looking to PICs for more stable and scalable quantum systems. PICs are used in photonic quantum systems to achieve the precise control of photons necessary for quantum computation.

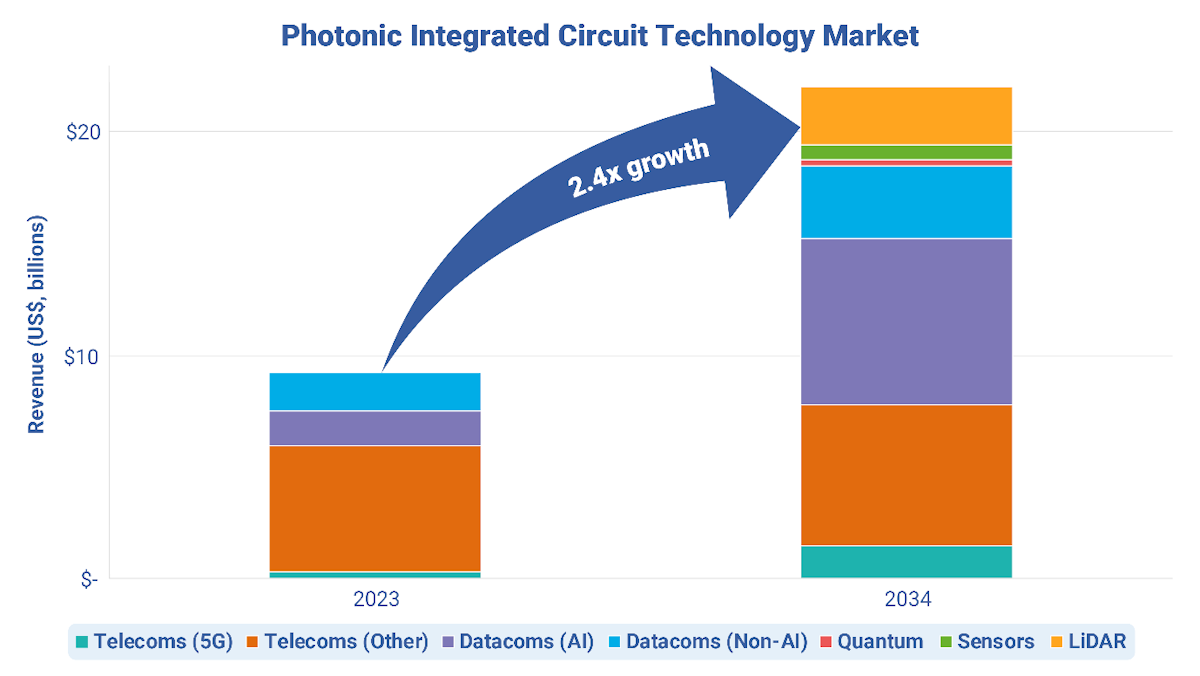

The 8% CAGR of the PIC market is set to be fueled by applications in Quantum, 5G, LiDAR, Sensors (such as Biosensors and Gas Sensors), and Datacoms for AI. Source: IDTechEx

The market for Silicon Photonics and PICs is experiencing robust growth, driven by the surge in AI and datacom transceiver demand. Key players in the industry, such as Intel/Jabil, Coherent, and Infinera, are actively using PICs within their transceivers. Innolight, a China-based transceiver company, hit 1.6Tbps of transfer speed in their latest transceivers in late 2023, which are due to start shipping for data-center applications in 2024. Coherent, which has its own InP wafer fab facilities, is also developing higher-performance transceivers for 1.6T+ applications. Intel Silicon Photonics, which is potentially going to be acquired by manufacturing firm Jabil, sold ~1.7 million PICs in 2023, according to IDTechEx's analysis, and is continuing to develop datacom and telecom transceivers. IDTechEx forecasts that PIC technology will continue dominating the high-performance transceiver market, further solidifying its position as a critical component in the modern technological landscape.

Key aspects of the IDTechEx report, "Silicon Photonics and Photonic Integrated Circuits 2024-2034: Market, Technologies, and Forecasts", include:

- Key Player Analysis for the High-Performance PIC-based Transceiver Market

- A breakdown of Co-Packaged Optics and its key concepts

- Analysis of Photonic Integrated Circuits for Quantum Systems

- Benchmarks and comparisons of photonic materials, with an industry breakdown by material. It also includes an insight into emerging materials such as Thin-Film Lithium Niobate (TFLN) and Barium Titanite (BTO).

- Photonic Integrated Circuit Fundamentals and Key Concepts, including important components and underlying principles.

- An analysis of how AI is changing demand for PIC-based transceivers, with a look at how Nvidia's recommended server architecture requires large numbers of transceivers.

- An overview of PIC manufacturing techniques.

- A look into future applications of PICs such as interconnects, LiDAR, biosensors, and gas sensors.

To find out more about this report, including downloadable sample pages, please visit www.IDTechEx.com/SemiPIC.

Upcoming free-to-attend Webinar

Photonic Integrated Circuits: Materials, Forecasts, and How AI Accelerator Demand Is Affecting the PIC Market

James Falkiner, Technology Analyst at IDTechEx and author of this article, will be presenting a free-to-attend webinar on the topic on Thursday 30 May 2024 - Photonic Integrated Circuits: Materials, Forecasts, and How AI Accelerator Demand Is Affecting the PIC Market.

This webinar will include:

- What is a photonic integrated circuit?

- What are current and future applications for PICs?

- An insight into IDTechEx's Total PIC Market Forecasts

- How AI accelerator demand is affecting the PIC Transceivers market

- The roadmap for the future of Datacom Transceivers

- PIC Material Benchmarks and Forecasts

Please click here to check timings and register for your specific time zone.

If you are unable to make the date, please register anyway to receive the links to the on-demand recording (available for a limited time) and webinar slides as soon as they are available.

IDTechEx provides trusted independent research on emerging technologies and their markets. Since 1999, we have been helping our clients to understand new technologies, their supply chains, market requirements, opportunities and forecasts. For more information, contact research@IDTechEx.com or visit www.IDTechEx.com.